TIAA, one of the largest pension funds in the US, recently boasted about its sustainable money management when it comes to climate change. Yet the pension giant is currently using tens of billions of dollars of members’ hard-earned savings to lubricate the industries that are exacerbating climate change. TIAA’s investments in coal mines, gas power plants and fracking companies not only undermine efforts to keep global warming below 1.5o C, but they are also financially risky.

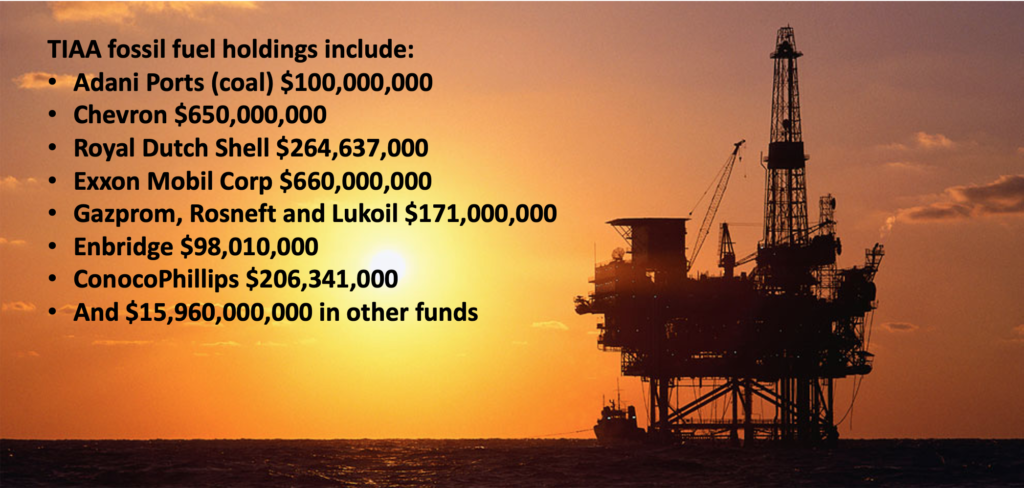

TIAA manages more than $1.3 trillion in assets, comprising a complex constellation of funds and investment products. The Institute for Energy Economics and Financial Analysis (IEEFA), an energy economics think tank studied TIAA’s public records and found that the company maintains at least $78 billion in fossil fuel assets. IEEFA’s report finds that “TIAA’s $1.4 trillion portfolio is awash in fossil fuel investments”.

Fossil Free Funds, a project hosted by the non-profit As You Sow, dove into TIAA’s mutual funds and uncovered $14.5 billion in fossil fuel investments. Fossil Free Funds combed through the mutual funds, assigning each a letter grade based on the fund’s investment in energy and utility companies. If a fund doesn’t invest in any of the several thousand companies targeted by Fossil Free Funds, it earns an A grade.

Fossil Free Funds awarded many of TIAA’s funds a grade of D for excess investment in coal and oil. For instance, the D-rated TIAA-CREF Equity Index Fund, pours $ 2.53 billion into the fossil fuel industry overall. The fund underwrites oil majors such as ExxonMobil, Chevron Corporation, and ConocoPhillips.

TIAA is among the top 20 holders of toxic bonds, financing major fossil fuel projects around the world, estimated at $8 billion. Fossil fuel companies rely on the corporate bond market for access to cheap financing for their exploration and extraction projects and TIAA views these bonds as a safe income stream.

In April 2023, investigative website LittleSis published “Mapping the Power Behind the Willow Project“. Investigative Journalist Derek Seidman finds that Nuveen, a TIAA subsidiary, is the 17th top shareholder in ConocoPhillips, with a 1.1% stake worth $1.624 billion. According to Seidman, “The controversial Willow project is a massive crude oil drilling operation proposed by fossil fuel behemoth ConocoPhillips in Alaska’s Northern Slope. The $8 billion project has been called a “carbon bomb” that could spew around 280 million metric tons of carbon emissions into the atmosphere. It has faced widespread opposition from climate and Indigenous advocates and is being challenged in the courts.”

Meanwhile, UN Secretary General Antonio Guterres recently warned that oil and gas exploration must stop, and financing of coal must end. TIAA did not get the message as it is now a major investor in the Adani Group conglomerate, the company behind the new Carmichael coal mine in Australia. Once fully developed, the open-pit mine will become the biggest in the world, and could emit 78 million tonnes of CO2 annually.

As well as flouting the recommendations of scientists to immediately cease fossil fuel use, these investments are financially risky. The Adani Group is the second-most exposed company to stranded asset risk of coal power stations in the entire world, according to Carbon Tracker, an independent financial think tank.

If you want TIAA to invest YOUR MONEY to propel businesses to build green power systems, not coal, gas and oil projects, click here to join our campaign.